Difference between revisions of "Input-output matrix"

| Line 8: | Line 8: | ||

Input-output matrix is constructed on the simple idea that goods and services produced by economic sectors should be registered in a table simultaneously by origin and by destination [http://www.oecd.org/dataoecd/6/34/37349386.pdf (OECD, 2006)]<ref>'''OECD (Organisation for Economic Co-operation and Development), 2006.''' ''Input-output analysis in an increasingly globalised world: applications of OECD’s harmonized international tables.'' STI/Working paper 2006/7. Statistical analysis of Science, Technology and Industry. 31st August. Available on Internet : http://www.oecd.org/dataoecd/6/34/37349386.pdf</ref>. | Input-output matrix is constructed on the simple idea that goods and services produced by economic sectors should be registered in a table simultaneously by origin and by destination [http://www.oecd.org/dataoecd/6/34/37349386.pdf (OECD, 2006)]<ref>'''OECD (Organisation for Economic Co-operation and Development), 2006.''' ''Input-output analysis in an increasingly globalised world: applications of OECD’s harmonized international tables.'' STI/Working paper 2006/7. Statistical analysis of Science, Technology and Industry. 31st August. Available on Internet : http://www.oecd.org/dataoecd/6/34/37349386.pdf</ref>. | ||

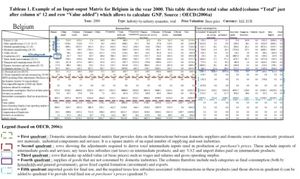

| − | Commodities are produced by economic sectors (e.g. cotton produced by agriculture) and they serve as inputs in other sectors in order to produce their final products also called outputs (e.g. manufacturing industry such as textile industry using cotton from agriculture as input to produce its own output, i.e. clothes in cotton). Better said, the purchase of agricultural output by manufacturing is for use as inputs in producing manufacturing output. Such purchases are part of what is known as intermediate demand, which term refers to inter-industry transactions, i.e. goods and services bought by firms from other firms and used up in current production (this corresponds to Domestic intermediate matrix – see '''first quadrant''' in Table 1). The outputs are delivered to the final demand sector that comprises purchases by individuals for consumption, by firms for investment (in fixed capital such as machines, buildings, etc.), by government, and by foreigners (exportations) – this corresponds to the '''fourth quadrant''' in Table 1 called Domestic investment matrix. The use of this terminology “final demand” simply indicates that purchases by this sector are not for the purpose of use in production (Common and Stagl, 2005). In addition to intermediate inputs mentioned above, firms use also primary inputs. Those are services which are not bought from other firms but from individuals : these services are known as factors of production. These refer to wages and salaries as payments for labour services, interests paid on borrowing, rent paid for the use of equipment, building and land, profits paid for the entrepreneurship that is the function of organizing and risk-taking (Common and Stagl, 2005) – this corresponds to the '''second quadrant''' in Table 1, which is called Imported intermediate products matrix. We are not going to detail the '''third''' and the '''fifth quadrant''' here since they are not essential to the global understanding of the methodology. For more details, look at the legend of Table 1 go to OECD (2006) and read pp.7-9. | + | Commodities are produced by economic sectors (e.g. cotton produced by agriculture) and they serve as inputs in other sectors in order to produce their final products also called outputs (e.g. manufacturing industry such as textile industry using cotton from agriculture as input to produce its own output, i.e. clothes in cotton). Better said, the purchase of agricultural output by manufacturing is for use as inputs in producing manufacturing output. Such purchases are part of what is known as intermediate demand, which term refers to inter-industry transactions, i.e. goods and services bought by firms from other firms and used up in current production (this corresponds to Domestic intermediate matrix – see '''first quadrant''' in [http://dev.ulb.ac.be/~sameyer/CEESE/documents/Table%201.pdf Table 1]). The outputs are delivered to the final demand sector that comprises purchases by individuals for consumption, by firms for investment (in fixed capital such as machines, buildings, etc.), by government, and by foreigners (exportations) – this corresponds to the '''fourth quadrant''' in Table 1 called Domestic investment matrix. The use of this terminology “final demand” simply indicates that purchases by this sector are not for the purpose of use in production (Common and Stagl, 2005). In addition to intermediate inputs mentioned above, firms use also primary inputs. Those are services which are not bought from other firms but from individuals : these services are known as factors of production. These refer to wages and salaries as payments for labour services, interests paid on borrowing, rent paid for the use of equipment, building and land, profits paid for the entrepreneurship that is the function of organizing and risk-taking (Common and Stagl, 2005) – this corresponds to the '''second quadrant''' in Table 1, which is called Imported intermediate products matrix. We are not going to detail the '''third''' and the '''fifth quadrant''' here since they are not essential to the global understanding of the methodology. For more details, look at the legend of Table 1 go to OECD (2006) and read pp.7-9. |

[[image:Table_1_Version_4.JPG|thumb|right|Table 1]] | [[image:Table_1_Version_4.JPG|thumb|right|Table 1]] | ||

Revision as of 15:15, 18 June 2007

This page is a first draft

(It still needs to pass through an internal and external review process)

An Input-output matrix is a representation of national or regional economic accounting that records the ways industries trade with one another as well as produce for consumption and investments.

Input-output matrix is constructed on the simple idea that goods and services produced by economic sectors should be registered in a table simultaneously by origin and by destination (OECD, 2006)[1]. Commodities are produced by economic sectors (e.g. cotton produced by agriculture) and they serve as inputs in other sectors in order to produce their final products also called outputs (e.g. manufacturing industry such as textile industry using cotton from agriculture as input to produce its own output, i.e. clothes in cotton). Better said, the purchase of agricultural output by manufacturing is for use as inputs in producing manufacturing output. Such purchases are part of what is known as intermediate demand, which term refers to inter-industry transactions, i.e. goods and services bought by firms from other firms and used up in current production (this corresponds to Domestic intermediate matrix – see first quadrant in Table 1). The outputs are delivered to the final demand sector that comprises purchases by individuals for consumption, by firms for investment (in fixed capital such as machines, buildings, etc.), by government, and by foreigners (exportations) – this corresponds to the fourth quadrant in Table 1 called Domestic investment matrix. The use of this terminology “final demand” simply indicates that purchases by this sector are not for the purpose of use in production (Common and Stagl, 2005). In addition to intermediate inputs mentioned above, firms use also primary inputs. Those are services which are not bought from other firms but from individuals : these services are known as factors of production. These refer to wages and salaries as payments for labour services, interests paid on borrowing, rent paid for the use of equipment, building and land, profits paid for the entrepreneurship that is the function of organizing and risk-taking (Common and Stagl, 2005) – this corresponds to the second quadrant in Table 1, which is called Imported intermediate products matrix. We are not going to detail the third and the fifth quadrant here since they are not essential to the global understanding of the methodology. For more details, look at the legend of Table 1 go to OECD (2006) and read pp.7-9.

Table 1 shows an example of a real input-output matrix for Belgium in the year 2000. The columns represent the destination of inputs, and the rows sum the output of a sector. As you can see, only the total outputs (last line called industry output) are shown, not the total inputs. This is because such data is not necessary since the total inputs equal the total outputs. Normally, this total appears in the last column of the table.

Practical use of Input-output tables

If we want to estimate without Input-output analysis, which additional inputs would be needed if the fishing sector increased its production by one unit, we would need to measure the following : i) first round, direct effects on the industries that supply the fishing sector with nets, boats, fishing rods etc; and ii) a range of secondary (indirect) effects, since these supplier industries themselves require additional inputs for their production, in order to meet the additional demand coming from the fishing sector production system.

Fortunately, input-output matrices offer a solution to solve such problems immediately taking into account both direct as well as indirect effects. This can be particularly appreciable for assessing economic impact (both ex-ante and ex-post) of policy changes. Environmental impact can even be analyzed if we add environmental data to classical input-output tables in order to build green input-output tables.

For instance, if a policy option scenario for marine pollution management (e.g. a tax on plastic industry resulting in higher plastic prices or a governmental subsidies to the production of material of substitution that are biodegradable) results in technical changes or in changes in final demand for plastics (a valuable material particularly in construction, packaging and fishing gear applications), I-O analysis can help us to deduce the following (adapted from Leontief, 1974, 193-209 pp.) :

- the policy options impact on the total level of pollution by plastic microparticles in the sea - the amount of pollution reduction in a particular sector resulting from the implementation of a policy option - the total pollution resulting from the final demand (demand from households, …) for products of each sector. For instance, keeping the example of plastic production, this means that the I-O table can tell us : “from the total amount Y of plastic pollutant in the sea, X tones are linked to agriculture, industrial and services activities contributing directly or indirectly to the supply of agricultural products to households. This is interesting since it does not only take into account the amount of pollutants from the agriculture sector for the production of agricultural products, but it also encompasses pollutants from other sectors intervening in the production of agricultural products. That is important since the agriculture sector also needs industrial products and services to generate its production. The same can be calculated for the supply of industrial products and services to households. - the impact of policy options on production level in other sectors (and so on the economy) - the impact of policy options on total employment in the region or in a particular sector - the impact of policy options on prices of goods and services

Limits of the method

The input-output (I-O) analysis is not able to capture environmental measures with a small economic impact (on GDP, on production, on employment…at national or regional level) because of data are too aggregated. Therefore, I-O is only relevant for activities having a wide economic impact such as construction of large infrastructures (railways or motorways infrastructure), modification of port activities, implementation of environmental policies targeting a whole sector, subsector or a branch of economic activities, etc.

Nevertheless, I-O analysis could also be relevant for a package of several policy options, each having a relatively small impact, but whose sum results in a large impact on the regional economy.

Walter Hecq (2006a) summarized several other limits of I-O analysis. They are mentioned below.

First of all, environmental measure might affect output prices. For instance, if a governmental policy make compulsory for oil companies to install an oil desulfuration system (that prevents acid rains), the cost of this depollution system will be reflected in oil price. Hence, all products requiring oil in their fabrication process will see their price modified too (e.g.: outputs from agriculture, electricity, ferrous metals, etc.). And due to an increase in their price, the demand for each of these products will probably decrease. The modification of the demand due to price variation must be integrated into I-O models but this makes them heavier to handle because of numerous products and/or diverse response functions. In that case, dynamic model such as CGE might be more suitable.

Moreover, I-O matrices give a static vision of the economy making difficult projections possibilities. However, it is possible to build dynamic I-O matrices but this is a bit more complicated.

Another disadvantage is the impossibility of substitution between production factors (labour, technical capital, land) while environmental policies might precisely have a structural effect on the long run on that aspect. Let’s take the example of an environmental policy aiming at decreasing green house gases emissions by promoting research and development in energy efficiency in households. Imagine the instrument of this policy would consist in public subsidies to universities for research in building insulation new technologies. Such a measure might lead to reduction of households energy consumption and so a reduction in natural gas extraction burnt in power plants for electricity generation. In that case, the production factor “land” in the form of a natural resource (natural gas) has been partly substituted by the production factor “labour” (development of human knowledge in new insulation techniques).

Furthermore, I-O tables are published by national and regional authorities with few years delay. For instance in Belgium in 2007, the last I-O table available dates from 2000. Through the delayed publishing of national I-O tables, factor relations within single sectors can be changed to a quite big extend. Such old data on the status of the economy might make I-O analysis for the subsequent years quite inaccurate. However there are techniques enabling to actualize too old I-O matrices.

The last limit we would like to highlight is the need of regionalization of national I-O tables. It can happen that you find only national I-O tables while you want to work at regional level (i.e. at a smaller spatial scale). In that case you will need to apply regionalization methods which add to the difficulties.

References

- ↑ OECD (Organisation for Economic Co-operation and Development), 2006. Input-output analysis in an increasingly globalised world: applications of OECD’s harmonized international tables. STI/Working paper 2006/7. Statistical analysis of Science, Technology and Industry. 31st August. Available on Internet : http://www.oecd.org/dataoecd/6/34/37349386.pdf